Health insurance costs for Americans aged 62 to 65 can be a crucial financial consideration as they approach retirement. During this transitional period, many individuals find themselves in a unique gap—too young for Medicare and often too old for employer-sponsored plans. Understanding the nuances of health insurance in this age bracket is essential to effectively plan for healthcare expenses and avoid financial surprises. As life expectancy continues to rise, managing health-related costs during the pre-Medicare years has become increasingly important for financial stability and peace of mind.

Healthcare in retirement is not just about managing current medical needs; it also involves anticipating future health challenges and the associated costs. The financial burden of health insurance can vary significantly based on factors like geographic location, health status, and plan selection. To make informed decisions, it’s vital to comprehend the average costs, coverage options, and strategies for minimizing expenses. This guide explores the critical elements of health insurance for Americans aged 62 to 65, providing practical insights into cost-effective planning.

You may also like: 10 Powerful Reasons to Retire Early and Transform Your Financial Future

Understanding the Average Cost of Healthcare in Retirement

Healthcare costs represent one of the most substantial expenses for retirees. For those aged 62 to 65, the financial implications can be particularly daunting. The average cost of healthcare in retirement encompasses not only insurance premiums but also out-of-pocket expenses such as deductibles, copayments, and non-covered medical treatments. According to recent studies, a typical retired couple can expect to spend well over $300,000 on healthcare during their retirement years—a figure that underscores the need for strategic planning.

Health insurance premiums for this age group often reflect both individual health risks and broader market factors. Private insurance plans, marketplace options, and COBRA extensions can vary widely in price, sometimes reaching up to $1,000 per month or more per individual, depending on the coverage and state of residence. For many, these costs are a significant portion of their retirement budget, making it imperative to compare plans and consider factors like deductibles, maximum out-of-pocket costs, and network restrictions.

Out-of-pocket expenses also contribute significantly to overall healthcare costs. These include prescription medications, medical supplies, and specialized treatments that may not be fully covered by standard insurance plans. Planning for these additional costs can help prevent financial strain, especially when unexpected medical issues arise. Furthermore, understanding the scope of coverage and exclusions within health insurance policies can help retirees avoid surprise expenses.

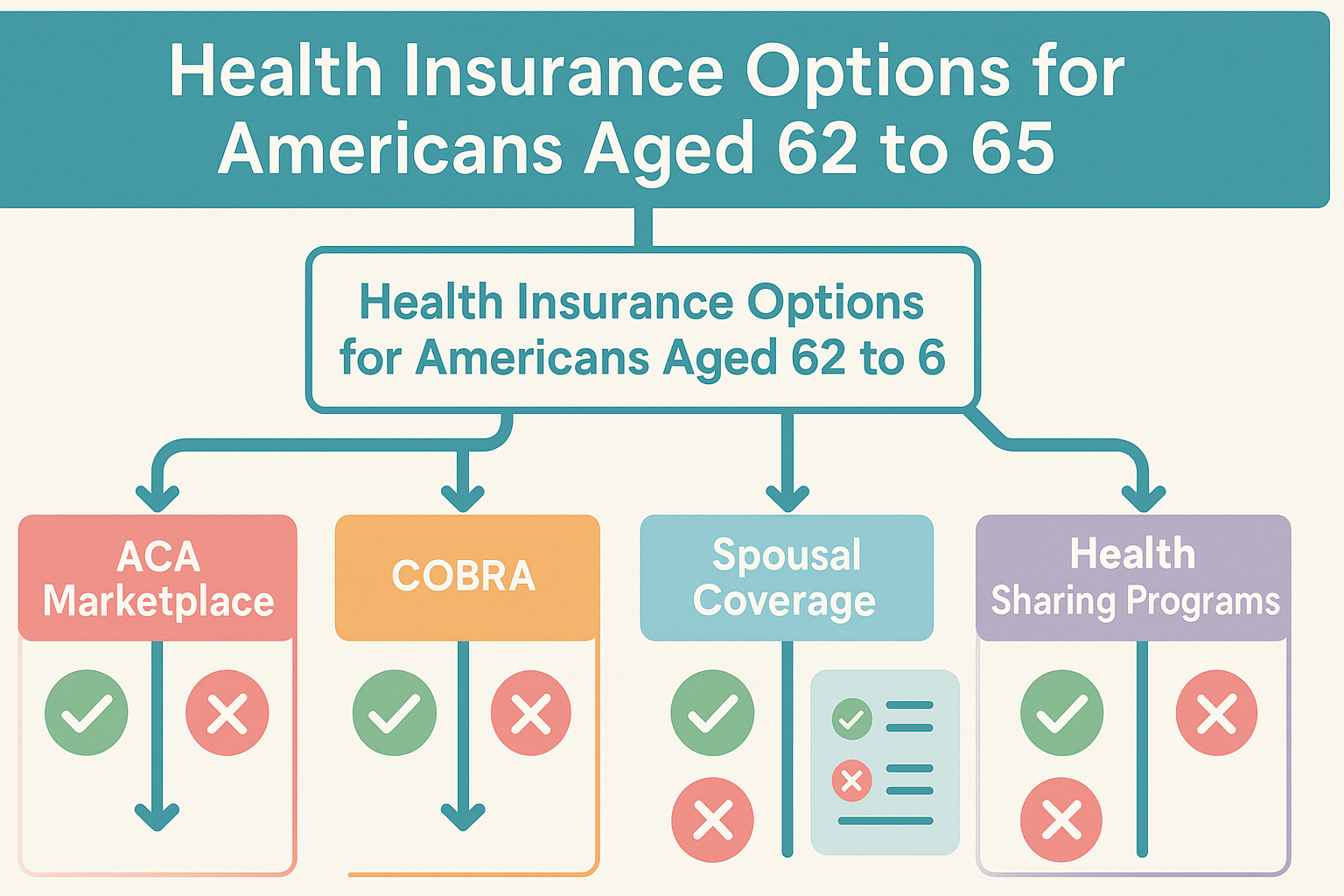

Health Insurance Options for Americans Aged 62 to 65

Navigating health insurance options before Medicare eligibility begins at age 65 can be challenging. However, several viable paths can bridge the gap and provide necessary medical coverage. The primary options include:

- Marketplace Insurance Plans: Established under the Affordable Care Act (ACA), marketplace insurance plans offer coverage for those under 65 who do not have access to employer-sponsored insurance. Subsidies based on income can significantly reduce premium costs, making these plans an attractive option for early retirees.

- COBRA Continuation Coverage: The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows individuals to extend their employer-sponsored health insurance for up to 18 months after leaving their job. While convenient, COBRA is often expensive, as retirees are required to pay the full premium plus an administrative fee.

- Private Health Insurance: Private insurance plans can be tailored to individual needs, offering varying levels of coverage and flexibility. Although often pricier than marketplace plans, they sometimes provide broader networks and better access to specialized care.

- Spousal Coverage: If a spouse is still employed and receives health insurance benefits, retirees aged 62 to 65 may be eligible for coverage under their spouse’s plan. This option can be cost-effective, particularly if the employer subsidizes a significant portion of the premiums.

- Health Sharing Programs: Some early retirees opt for health-sharing programs, which pool resources among members to cover medical expenses. While not technically insurance, these programs can offer a form of financial protection, although they may not cover all medical treatments.

Each of these options has its own benefits and drawbacks, which must be carefully considered based on individual health needs and financial circumstances. Understanding the nuances of each plan type can help retirees make informed decisions that align with their healthcare needs and budget.

Average Monthly Health Insurance Costs for Retired Couples

One of the most pressing questions for retirees is understanding the average monthly health insurance cost for a retired couple. This figure varies widely depending on factors such as geographic location, health status, and the type of insurance coverage selected. On average, a retired couple can expect to pay between $800 and $1,500 per month for health insurance coverage if they are purchasing plans through the ACA marketplace or private insurers.

These costs include premiums, deductibles, and potential out-of-pocket expenses that can add up over time. Couples who choose high-deductible health plans (HDHPs) often pay lower premiums but must be prepared for higher upfront costs if medical services are needed. Conversely, more comprehensive plans may have higher monthly premiums but lower deductibles and copayments.

For couples exploring COBRA as a bridge to Medicare, the costs are typically even higher. Without employer subsidies, COBRA premiums can easily exceed $1,500 per month, straining retirement budgets. Therefore, comparing options and understanding the total cost of coverage—including hidden fees and variable costs—is essential for effective financial planning.

Strategies for Reducing Health Insurance Costs

Managing health insurance costs during the pre-Medicare years is crucial for many Americans. Fortunately, there are practical strategies that can help reduce these expenses without sacrificing necessary coverage. One of the most effective approaches is to explore marketplace subsidies under the Affordable Care Act (ACA). These subsidies are based on income levels and can significantly reduce monthly premiums for individuals and couples who meet the criteria.

Additionally, choosing a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA) can provide both immediate savings and long-term benefits. HSAs allow for tax-free contributions that can be used to cover medical expenses, and any unused funds roll over year after year, providing a financial cushion for future healthcare costs.

Preventive care is another key strategy. Many health insurance plans fully cover preventive services such as annual check-ups, vaccinations, and screenings. Taking advantage of these services can help catch medical issues early, reducing the need for more costly treatments later on. Furthermore, comparison shopping for prescription medications, exploring generic options, and utilizing mail-order pharmacies can also help cut costs.

Finally, maintaining a healthy lifestyle can significantly reduce healthcare expenses. Preventing chronic conditions through regular exercise, balanced nutrition, and routine health check-ups not only enhances quality of life but also minimizes the need for expensive medical interventions. Studies have consistently shown that individuals who engage in regular physical activity, consume a balanced diet rich in vitamins and nutrients, and prioritize preventive care have lower long-term medical costs. Preventive measures, such as annual health screenings, vaccinations, and regular monitoring of chronic conditions, can detect issues early when they are most treatable and least expensive to manage. Strategic planning and proactive health management are essential for optimizing health insurance expenditures during this critical life stage, ultimately contributing to both financial security and well-being. Beyond immediate savings, these health strategies also contribute to long-term financial security. Early intervention through preventive care, exercise, and proper diet helps in managing chronic conditions like diabetes, hypertension, and heart disease—conditions that often require costly treatments and ongoing medical supervision. For instance, regular monitoring of blood pressure, cholesterol levels, and blood sugar can prevent the escalation of minor health issues into severe complications that would otherwise demand expensive medical care.

Moreover, strategic use of Health Savings Accounts (HSAs) can act as a buffer against future health expenses. Unlike standard savings accounts, HSA contributions are tax-deductible, and withdrawals for medical expenses are tax-free. This dual advantage allows retirees to save significantly on healthcare costs while also investing in their long-term health needs. Building a robust HSA during working years can ease the financial pressure during the pre-Medicare gap, providing a ready pool of funds for medical expenses without impacting retirement savings.

Another critical aspect of long-term planning is evaluating long-term care insurance. As individuals age, the likelihood of needing long-term care—whether in-home assistance, assisted living, or nursing home care—increases. Long-term care insurance helps manage these costs, which are typically not covered by Medicare. Early investment in a policy not only reduces premiums but also secures access to quality care without depleting personal savings.

Finally, early retirees should consider supplemental insurance plans like Medigap or Medicare Advantage once they reach eligibility. These plans fill the gaps left by standard Medicare, covering additional expenses such as copayments, deductibles, and extended hospital stays. Understanding these options and integrating them into a broader financial strategy ensures a smoother transition to Medicare and protects against unexpected medical expenses.

Proactive financial planning, healthy lifestyle choices, and smart insurance investments are the pillars of minimizing health insurance costs for Americans aged 62 to 65. By anticipating medical needs, leveraging preventive care, and optimizing savings strategies, retirees can enjoy both financial security and peace of mind as they move toward their golden years.

FAQ – Health Insurance Costs for Americans Aged 62 to 65

What Are the Average Health Care Costs in Retirement?

The average health care costs in retirement can be substantial, often ranging between $300,000 and $400,000 for a typical retired couple. These expenses include premiums for health insurance, out-of-pocket costs for doctor visits, prescriptions, and medical supplies. Beyond direct costs, retirees must also consider long-term care, which is often not covered by standard health insurance. Many retirees are surprised by the extent of these expenses, which can significantly impact their savings if not planned for in advance. Understanding these costs and incorporating them into a broader retirement strategy is crucial for financial stability.

How Much Does Health Insurance Cost for Retirees?

Health insurance costs for retirees vary widely depending on factors like geographic location, health status, and the type of coverage chosen. On average, retirees aged 62 to 65 who are not yet eligible for Medicare may pay between $800 and $1,500 per month for health insurance coverage. These premiums are influenced by plan selection—high-deductible plans may reduce monthly costs but increase out-of-pocket expenses. Many retirees seek marketplace plans under the Affordable Care Act (ACA) to find subsidized options that fit their budgets. Thorough comparison shopping and understanding of benefits are essential for minimizing costs.

What Is the Average Monthly Health Insurance Cost for a Retired Couple?

The average monthly health insurance cost for a retired couple typically ranges from $800 to $1,500 if purchased through private insurance or the ACA marketplace. This figure includes not just premiums but also potential out-of-pocket costs like deductibles and copayments. Retired couples who opt for high-deductible health plans (HDHPs) may pay lower monthly premiums but face higher upfront costs when accessing care. For those extending employer-sponsored insurance through COBRA, monthly costs can exceed $1,500, making alternative plans worth exploring. Strategic planning and comparison are key to managing these costs effectively.

How Can Americans Aged 62 to 65 Reduce Health Insurance Costs?

There are several effective strategies for reducing health insurance costs for Americans aged 62 to 65. First, exploring subsidies available through the Affordable Care Act (ACA) can significantly lower monthly premiums for those who qualify. Additionally, opting for a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA) can provide tax advantages and savings opportunities. Preventive care, which is often fully covered under health plans, can also help detect medical issues early, avoiding costly treatments. Lifestyle choices such as maintaining a healthy diet and regular exercise further reduce long-term health costs. Finally, comparison shopping for prescription drugs and medical services can uncover significant savings.

What Are the Best Health Insurance Options for Americans Aged 62 to 65?

Americans aged 62 to 65 have several viable health insurance options to consider before Medicare eligibility. These include marketplace insurance plans under the ACA, COBRA continuation coverage for those transitioning from employer-sponsored plans, and private health insurance tailored to individual needs. Spousal coverage may also be an option if a partner is still employed with health benefits. Health-sharing programs, while not traditional insurance, offer a community-based approach to sharing medical costs. Each option varies in cost and coverage, so careful comparison is essential for optimal savings and adequate protection.

How Much Is Insurance After Retirement?

The cost of insurance after retirement can be substantial, especially for those who retire before age 65 and are not yet eligible for Medicare. On average, health insurance premiums range from $800 to $1,500 per month for those purchasing coverage through the ACA marketplace or private insurers. High-deductible plans may reduce monthly premiums but require higher out-of-pocket payments when medical care is needed. For those extending employer-sponsored coverage through COBRA, costs can exceed $1,500 per month. Exploring all available options, including subsidies, can help manage these expenses effectively.

How Do Health Insurance Costs Change After Age 65?

After age 65, most Americans become eligible for Medicare, which significantly reduces health insurance costs. However, Medicare is not entirely free—there are monthly premiums for Part B (medical insurance) and additional costs for Part D (prescription coverage) and Medigap or Medicare Advantage plans. While these costs are generally lower than private insurance before age 65, they still require careful budgeting. Many retirees choose supplemental insurance to cover gaps in Medicare, such as deductibles and co-pays, ensuring broader protection against medical expenses.

What Are the Most Common Medical Expenses in Retirement?

Medical expenses in retirement extend beyond standard doctor visits and prescription costs. Common expenses include out-of-pocket costs for dental, vision, and hearing care, which are often not covered by Medicare. Long-term care, whether in assisted living facilities or through home healthcare services, is another significant cost that many retirees face. Additionally, the need for specialized treatments or surgeries can result in substantial expenses. Planning for these costs early, through savings or long-term care insurance, is crucial for financial stability in retirement.

How Can Long-Term Care Insurance Help Reduce Healthcare Costs in Retirement?

Long-term care insurance is a critical component of managing healthcare costs in retirement. It covers services not typically included in standard health insurance or Medicare, such as assisted living, in-home care, and nursing home stays. By paying premiums over time, retirees can protect their savings from the high costs associated with long-term care. Early enrollment in a long-term care plan can also reduce premium costs and guarantee access to quality care when it’s needed most. This form of insurance provides peace of mind and financial protection for both retirees and their families.

How Do Health Savings Accounts (HSAs) Benefit Retirees Before Medicare?

Health Savings Accounts (HSAs) are powerful tools for managing healthcare costs for retirees aged 62 to 65. These accounts allow for tax-free contributions, growth, and withdrawals when funds are used for medical expenses. HSAs paired with high-deductible health plans enable individuals to save specifically for healthcare costs while enjoying tax advantages. Unlike Flexible Spending Accounts (FSAs), HSA funds roll over each year, allowing retirees to build a substantial financial cushion for medical expenses. Strategic use of HSAs can ease the financial burden of healthcare before Medicare eligibility.

Conclusion: Securing Health Insurance Stability Before Medicare

Health insurance costs for Americans aged 62 to 65 represent a critical financial consideration in the journey toward retirement. Understanding available options, planning for average costs, and implementing strategic measures to reduce expenses can significantly enhance financial stability. As individuals transition to Medicare, preparedness for medical expenses and an understanding of potential gaps in coverage will further protect retirement savings and ensure a more secure and comfortable future.

How much does retirement health care cost?