Navigating the complexities of financial planning can often feel like charting unknown waters, especially when faced with unexpected life events that demand immediate financial relief. For many individuals, tapping into retirement savings through options like an e certified hardship withdrawal can provide a necessary lifeline during times of crisis. However, understanding the full scope of what this process entails, including its implications and requirements, is crucial to making informed decisions that do not compromise long-term financial security. This article explores everything you need to know about e certified hardship withdrawals, offering a comprehensive guide to eligibility, processes, common pitfalls, and strategic considerations.

You may also like: 10 Powerful Reasons to Retire Early and Transform Your Financial Future

Understanding e Certified Hardship Withdrawals

An e certified hardship withdrawal is a mechanism that allows individuals to access funds from their retirement accounts under specific conditions of financial hardship. Unlike traditional withdrawals, which may come with penalties if taken before the age of 59 ½, a hardship withdrawal is designed to alleviate immediate financial burdens caused by certain qualifying life events. These events typically include medical emergencies, imminent foreclosure, eviction, funeral expenses, and tuition payments. While the process may seem straightforward, it is governed by strict guidelines that dictate not only eligibility but also the permissible amount that can be withdrawn and how those funds may be used.

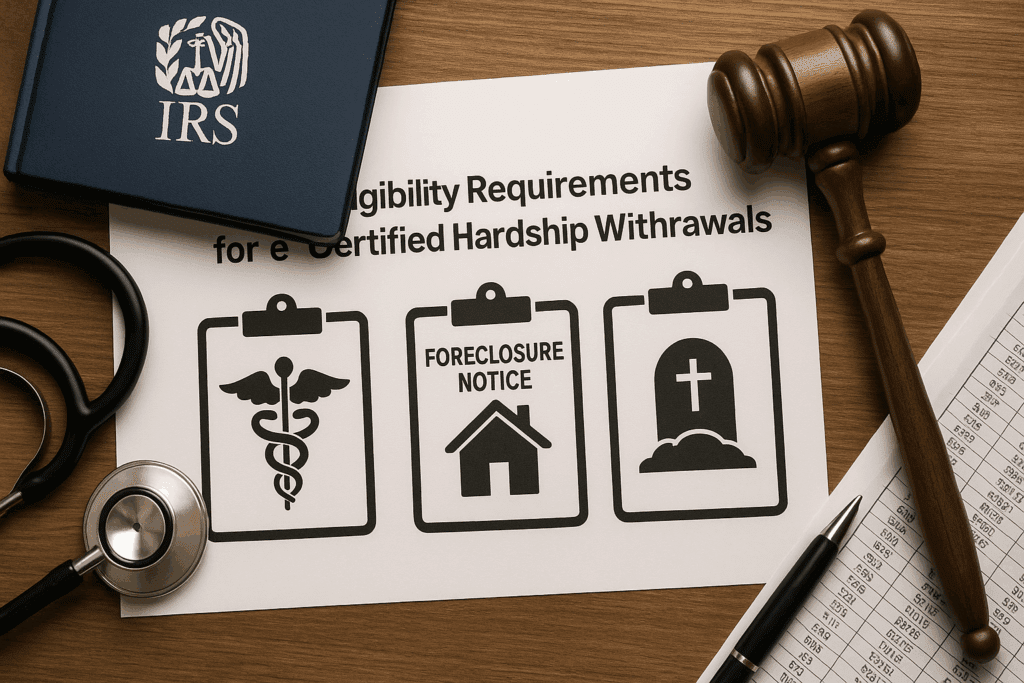

Eligibility Requirements for e Certified Hardship Withdrawals

To qualify for an e certified hardship withdrawal, you must demonstrate an immediate and heavy financial need. This requirement is assessed based on specific criteria outlined by the IRS and your retirement plan provider. Common qualifying scenarios include medical expenses that are not covered by insurance, costs related to the purchase of a primary residence, and expenses necessary to prevent eviction or foreclosure on your home. Additionally, tuition and related educational fees for post-secondary education, as well as funeral expenses for a close family member, may also justify the need for a hardship withdrawal. Understanding these qualifying events is critical, as improper application or misunderstanding of eligibility requirements can result in delays or denials.

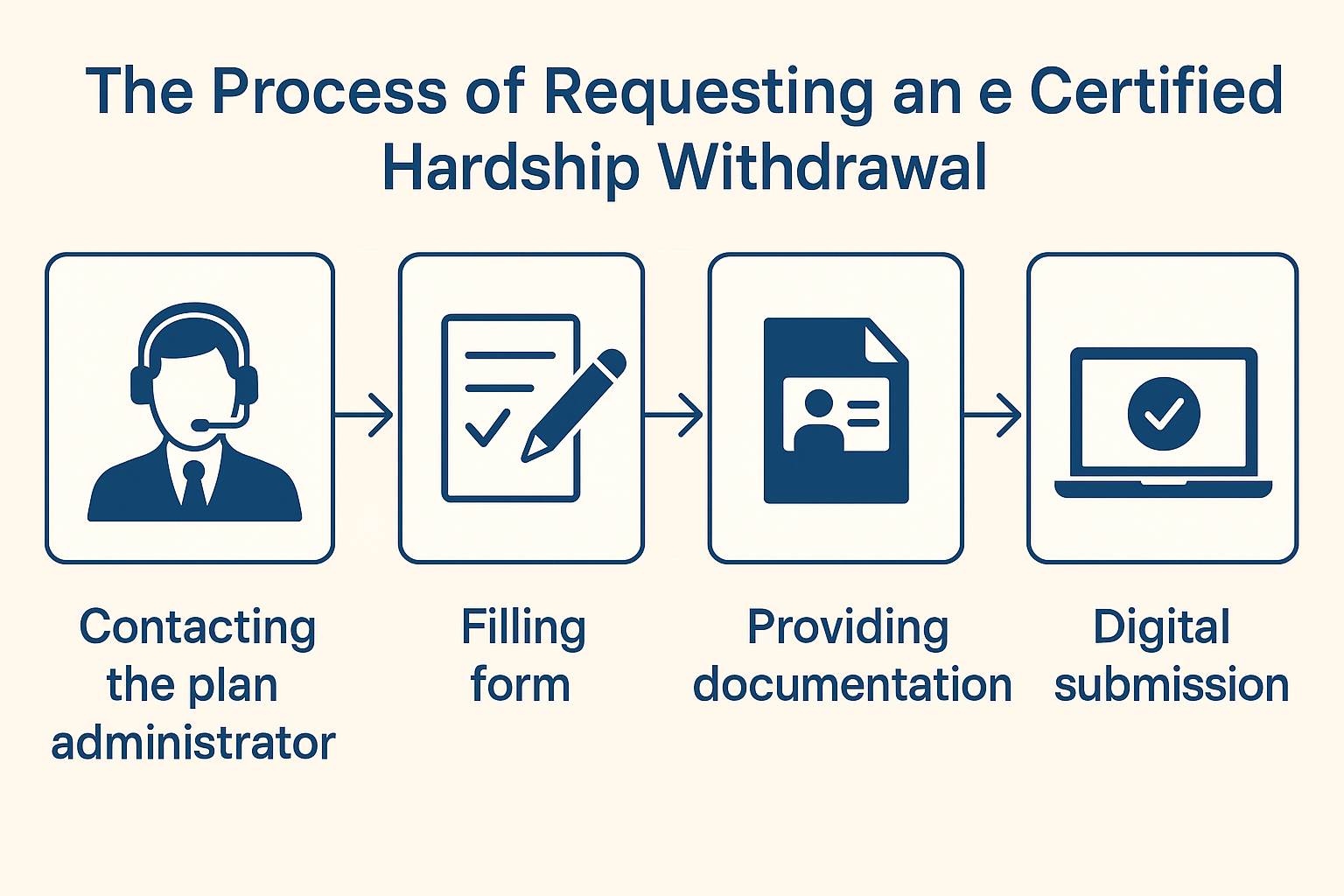

The Process of Requesting an e Certified Hardship Withdrawal

Requesting an e certified hardship withdrawal involves several steps, each requiring careful attention to detail. First, you must contact your plan administrator to initiate the request. Most retirement plans require documentation to verify your financial hardship, such as medical bills, eviction notices, or foreclosure letters. Additionally, you may need to complete a standardized form provided by your plan administrator, outlining the nature of your hardship and the amount you wish to withdraw. This process is typically streamlined through online portals, allowing for faster processing and real-time status updates.

Tax Implications and Penalties

One critical aspect of e certified hardship withdrawals is understanding the tax implications. Although these withdrawals are designed to provide financial relief, they are still considered taxable income. This means that the amount you withdraw will be added to your annual income for the year, potentially pushing you into a higher tax bracket. Moreover, unless you qualify for certain exceptions, you may also be subject to a 10% early withdrawal penalty if you are under the age of 59 ½. Being aware of these financial repercussions can help you better plan and budget for the tax impact of your hardship withdrawal.

Strategic Considerations Before Opting for a Hardship Withdrawal

Before deciding to take an e certified hardship withdrawal, it is essential to weigh the long-term implications. While accessing these funds may provide immediate relief, it can also significantly impact your retirement savings. Unlike a loan, which allows you to repay the amount back into your retirement account, a hardship withdrawal permanently reduces your balance. This reduction can affect your investment growth over time, potentially delaying your retirement goals. Therefore, exploring alternative financial solutions, such as short-term personal loans or negotiating payment plans, may be worth considering before depleting your retirement savings.

Common Mistakes to Avoid

Many individuals make critical mistakes when requesting a hardship withdrawal, often due to a lack of understanding of the requirements and implications. One common error is failing to provide sufficient documentation to verify the financial need, resulting in delays or outright denials. Another mistake is not fully considering the tax implications, leading to unexpected liabilities during tax season. Furthermore, some individuals mistakenly believe that the funds are a loan and can be repaid, not realizing that a hardship withdrawal is a permanent deduction from their retirement savings. Avoiding these pitfalls requires careful planning and a thorough understanding of the withdrawal process.

Exploring Alternatives to Hardship Withdrawals

Before settling on an e certified hardship withdrawal, it’s wise to explore alternative solutions. Options such as 401k loans, personal lines of credit, or negotiating payment plans with creditors can often provide the necessary financial relief without tapping into retirement savings. A 401k loan, for instance, allows you to borrow against your retirement account with the understanding that the amount will be repaid with interest, minimizing long-term impact. Similarly, personal lines of credit can serve as a temporary solution, offering flexible repayment options that do not deplete retirement funds. Weighing these alternatives can help you make a more informed decision that preserves your financial future.

Frequently Asked Questions (FAQ) on e Certified Hardship Withdrawal

What is an e Certified Hardship Withdrawal?

An e certified hardship withdrawal is a specific type of financial relief that allows individuals to access funds from their retirement savings under defined hardship circumstances. This option is typically used during times of financial crisis, such as unexpected medical expenses, foreclosure, eviction, or funeral costs. Unlike traditional loans from a 401k, an e certified hardship withdrawal does not require repayment. However, it is important to understand that these withdrawals are subject to income tax and may also incur a 10% penalty if taken before the age of 59 ½. The process is streamlined electronically, making it more efficient than traditional paper-based requests.

Can I Use an e Certified Hardship Withdrawal to Pay Off Credit Card Debt?

While an e certified hardship withdrawal is designed to alleviate immediate financial burdens, its usage for credit card debt is generally not permissible under standard 401k hardship withdrawal guidelines. The IRS has strict criteria that govern what constitutes a qualifying hardship, and credit card debt is typically not considered an eligible expense. However, if the debt is linked to medical expenses or other qualifying emergencies, it may be possible to justify the withdrawal. It’s crucial to consult with your plan administrator to understand your options and ensure compliance with federal regulations.

How Does a 401k Hardship Loan Differ from a Hardship Withdrawal?

A 401k hardship loan and a hardship withdrawal are two distinct financial tools. A 401k hardship loan allows you to borrow money from your 401k balance, which you must repay with interest over a specified period. This option preserves your retirement savings because the funds are returned to your account. In contrast, a hardship withdrawal permanently reduces your retirement savings, as the money is not repaid. Understanding these differences can help you decide which option best suits your financial situation during times of need.

What Qualifies as a Hardship for an e Certified Hardship Withdrawal?

The IRS sets specific criteria for what qualifies as a hardship for an e certified hardship withdrawal. Common qualifying events include preventing eviction or foreclosure, covering medical expenses not paid by insurance, funeral expenses for immediate family members, and educational costs like tuition. Additionally, the purchase of a primary residence may also be considered a qualifying hardship. Each plan may have unique guidelines, so it is important to review your retirement plan’s policies and consult with your plan administrator for clarity.

Can I Take Multiple Hardship Withdrawals in a Year?

The frequency of hardship withdrawals is typically governed by the rules of your retirement plan. Some plans may allow more than one hardship withdrawal per year, while others impose strict limits. It is important to note that each withdrawal is subject to taxation and potential penalties, making it critical to consider the financial impact of multiple withdrawals. Additionally, repeated withdrawals can significantly diminish your retirement savings, affecting long-term financial stability. Consulting with your plan administrator can provide clarity on the limitations specific to your account.

How Long Does It Take to Process an e Certified Hardship Withdrawal?

The processing time for an e certified hardship withdrawal varies depending on your plan provider. However, the electronic nature of the request typically accelerates the process compared to traditional methods. Most withdrawals are processed within seven to ten business days once all required documentation is submitted and approved. Factors such as incomplete forms or missing verification documents can cause delays. Ensuring that all paperwork is complete and accurate can expedite your application process.

Are There Tax Implications for Hardship Withdrawals?

Yes, there are significant tax implications for hardship withdrawals. Funds taken from your retirement account are considered taxable income for the year in which they are withdrawn. This additional income may push you into a higher tax bracket, increasing your overall tax liability. Furthermore, if you are under the age of 59 ½, a 10% early withdrawal penalty may apply, unless you qualify for specific exemptions. It is advisable to consult with a tax professional to understand the full impact of the withdrawal.

Can I Request a Hardship Withdrawal for Medical Bills?

Yes, medical bills are one of the primary reasons individuals seek hardship withdrawals from their 401k or other retirement accounts. According to IRS guidelines, expenses that are not covered by insurance and are necessary for medical care can qualify. This includes costs for treatments, surgeries, or critical care for you or a dependent. Be prepared to provide documentation, such as medical bills or statements, to validate your claim. Your plan administrator may require additional verification before approving your request.

How Do I Apply for an e Certified Hardship Withdrawal?

Applying for an e certified hardship withdrawal generally involves contacting your retirement plan administrator to begin the process. Most plan providers offer electronic portals that simplify the application by guiding you through each step. You will be required to submit documentation proving your financial hardship, such as medical bills, foreclosure notices, or tuition statements. Once your documentation is verified, the withdrawal amount is processed and sent to you, often through direct deposit. It is important to review all terms and conditions with your plan provider to understand the full implications of the withdrawal.

What Are the Long-Term Consequences of Hardship Withdrawals?

Hardship withdrawals can have long-lasting impacts on your financial future. Unlike loans, the money withdrawn is not repaid, resulting in a permanent reduction of your retirement savings. This decrease in your account balance can significantly affect the growth of your investments over time, potentially delaying your retirement. Additionally, the taxable nature of these withdrawals can create unexpected financial burdens during tax season. Considering alternative solutions, such as a 401k hardship loan or personal line of credit, may be beneficial before deciding to deplete your retirement savings.

Conclusion: Making Informed Decisions for Financial Stability

Navigating an e certified hardship withdrawal requires a balance of immediate financial relief and long-term planning. By understanding the eligibility requirements, the application process, and the associated tax implications, you can make informed decisions that protect your financial stability while addressing your urgent needs. As with any significant financial decision, it is wise to consult with a financial advisor to explore all available options and craft a strategy that aligns with your long-term goals. Thoughtful consideration and strategic planning can turn a difficult financial moment into a stepping stone for future stability and growth.

Further Reading:

How a 401(k) hardship withdrawal works