Social Security is a good example of effective government policy aimed at providing financial security for citizens in their retirement years. As one of the cornerstone social insurance programs in the United States, Social Security has proven to be a vital component in ensuring economic stability and preventing poverty among the elderly and disabled. Understanding its purpose, benefits, and long-term implications is essential not just for retirees, but for anyone planning their financial future. In this comprehensive guide, we will explore the origins, benefits, and economic significance of Social Security, while highlighting why it remains a key example of well-structured retirement planning.

You may also like: The Essential Guide to Finding the Best Retirement Calculator for Married Couples

Understanding the Basics of Social Security

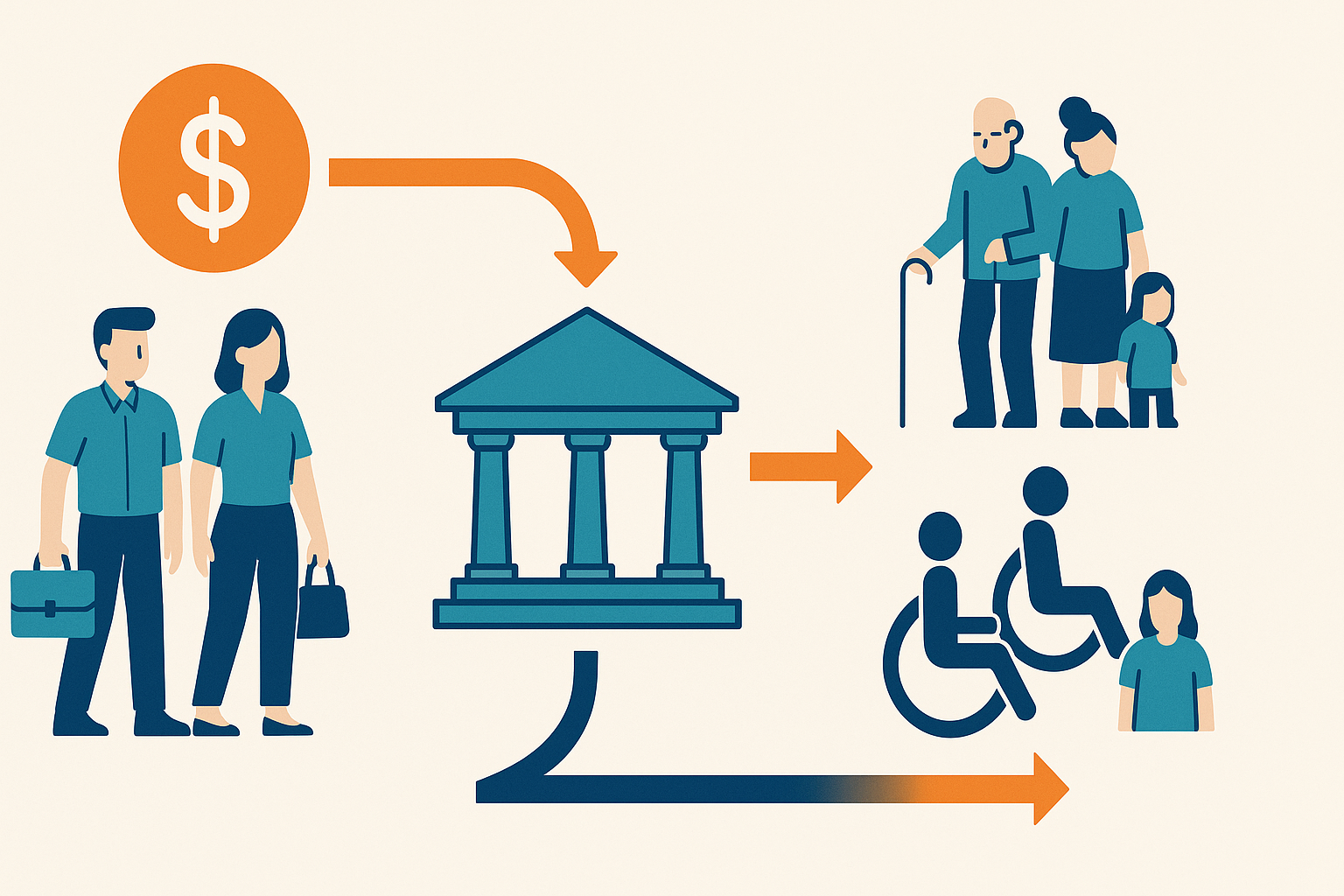

Social Security, formally known as the Old-Age, Survivors, and Disability Insurance (OASDI) program, is a federal initiative designed to provide a financial safety net for retirees, disabled individuals, and survivors of deceased workers. Funded through payroll taxes under the Federal Insurance Contributions Act (FICA), it has become a lifeline for millions of Americans. The concept of Social Security is grounded in the idea of collective responsibility—workers contribute a portion of their income during their employment years to fund benefits for current retirees, with the expectation that future generations will do the same.

The program was established in 1935 as part of President Franklin D. Roosevelt’s New Deal, aiming to alleviate the financial burden on elderly Americans during the Great Depression. Since then, it has expanded to include disability benefits, survivor benefits, and cost-of-living adjustments to keep pace with inflation. Today, Social Security is the largest source of income for most elderly Americans, underscoring its importance in the broader context of retirement planning.

Social Security as a Pillar of Retirement Planning

One of the most compelling reasons why Social Security is a good example of effective retirement planning is its predictability and stability. Unlike investments in the stock market, which are subject to volatility, Social Security benefits provide a steady income stream that is adjusted annually for inflation. This makes it a reliable foundation for retirement income, supplementing personal savings and other investments.

Additionally, Social Security offers protection against longevity risk—the risk of outliving one’s savings. Given the increasing life expectancy in the United States, many retirees face the challenge of ensuring their savings last throughout their lifetime. Social Security mitigates this concern by providing guaranteed monthly payments for life, reducing the financial uncertainty associated with aging. For many, this security allows for better financial planning and peace of mind during retirement.

Furthermore, Social Security benefits are calculated based on an individual’s highest 35 years of earnings, ensuring that long-term contributors are rewarded for their participation in the workforce. This structure not only incentivizes long-term employment but also promotes economic stability by redistributing income to those in need during their non-working years.

Advantages of Social Security in Retirement Planning

When it comes to retirement planning, the advantages of Social Security cannot be overstated. First and foremost, Social Security provides a reliable source of income that is unaffected by market fluctuations. This stability is particularly important for retirees who depend on consistent monthly payments to cover living expenses. Unlike private investments, which can rise and fall with economic conditions, Social Security remains a predictable income stream that millions of Americans rely on.

Another significant advantage is the cost-of-living adjustments (COLA) that Social Security implements each year. These adjustments are designed to keep up with inflation, ensuring that the purchasing power of benefits is maintained. This mechanism is vital for retirees on fixed incomes, helping them to manage rising costs without the need for drastic changes in their lifestyle.

Moreover, Social Security benefits extend beyond just the retired worker. Spouses, children, and even ex-spouses may be eligible for benefits, depending on specific conditions. This aspect of Social Security ensures that families are supported even if the primary earner passes away or becomes disabled. For many families, this additional support can mean the difference between financial stability and hardship.

Lastly, the structure of Social Security benefits also encourages long-term employment. Since benefits are calculated based on the highest 35 years of earnings, there is an inherent incentive for individuals to remain in the workforce and contribute to the system. This not only benefits individual workers but also strengthens the overall economic landscape.

Why Social Security is a Good Example of Economic Stability

One of the primary reasons why Social Security is a good example of economic stability lies in its funding structure. Social Security is primarily funded through payroll taxes, with contributions coming directly from workers and employers. This pay-as-you-go system ensures that there is a continuous flow of funds into the Social Security Trust Fund, which is then used to pay out current benefits. Because of this structure, Social Security is not as vulnerable to economic downturns as private investments are.

The predictability of Social Security payments also plays a crucial role in economic stability. Retirees and disabled individuals can rely on regular, predictable payments, which helps to stabilize consumption and maintain a baseline level of economic activity. During times of economic stress, these payments act as a buffer, preventing drastic drops in consumer spending.

Additionally, Social Security contributes to poverty reduction among the elderly. Before its establishment, nearly half of American seniors lived in poverty. Today, that number has been dramatically reduced, with Social Security lifting millions of older adults above the poverty line each year. This reduction in poverty not only improves the quality of life for seniors but also reduces the financial strain on government assistance programs.

The Role of Social Security in Reducing Economic Inequality

Social Security also plays a critical role in reducing economic inequality. By providing a baseline income to retirees, the disabled, and survivors, it helps to narrow the income gap that often widens with age and health-related issues. This safety net is particularly crucial for marginalized communities, who historically have had less access to wealth-building opportunities. Social Security serves as a form of income redistribution, ensuring that even those who have not been able to accumulate substantial wealth during their working years can still live with dignity and financial support during retirement.

The program’s progressive benefit structure is another contributing factor. Lower-income workers receive a higher percentage of their pre-retirement earnings as Social Security benefits compared to higher earners. This design inherently supports economic equity, reducing the disparities that can emerge over decades of workforce participation.

Additionally, Social Security’s role in supporting survivors and disabled individuals ensures that the most vulnerable populations are not left without financial assistance. This broad safety net helps to level the economic playing field, making it a critical element in the fight against poverty and economic disparity.

Frequently Asked Questions About Social Security

Why Is Social Security Considered a Good Example of Economic Stability?

Social Security is a good example of economic stability because it is funded through a pay-as-you-go system, which is primarily supported by payroll taxes. This system ensures that there is always a continuous flow of income into the Social Security Trust Fund, which is then used to pay out benefits to current recipients. Unlike market-driven investments, Social Security payments remain stable even during economic downturns, providing a reliable safety net for retirees and disabled individuals. This predictability is crucial for those who depend on consistent monthly payments to cover living expenses, especially during times of economic uncertainty. Additionally, Social Security helps maintain consumer spending, acting as a stabilizer during recessions and contributing to overall economic resilience.

What Are the Advantages of Social Security Over Private Retirement Savings?

One of the primary advantages of Social Security over private retirement savings is its guaranteed income. While private investments are subject to market fluctuations, Social Security provides consistent payments that are adjusted annually for inflation. This cost-of-living adjustment (COLA) ensures that recipients maintain their purchasing power, even as the cost of living increases. Moreover, Social Security benefits are not tied to individual investment risks, which means that retirees do not have to worry about losing their income due to poor market performance. This reliability makes Social Security a cornerstone of retirement planning for millions of Americans.

How Does Social Security Reduce Economic Inequality?

Social Security plays a significant role in reducing economic inequality by providing a safety net for low-income earners, retirees, and disabled individuals. Its progressive benefit structure ensures that lower-income workers receive a higher percentage of their pre-retirement earnings compared to high-income earners. This redistribution helps narrow the economic gap, particularly for individuals who have had limited access to wealth-building opportunities during their working years. Additionally, survivor and disability benefits extend financial support to families who might otherwise face economic hardship, further contributing to economic stability and reduced inequality.

What Is the Importance of Social Security for American Families?

The importance of Social Security for American families cannot be overstated. It serves as a financial lifeline not only for retirees but also for survivors of deceased workers and those with disabilities. Spouses and children of deceased or disabled workers often rely on these benefits to maintain financial stability during difficult times. This safety net ensures that families are not left destitute when the primary earner is no longer able to provide income. In many cases, Social Security helps keep families above the poverty line, making it an essential component of economic security for millions of Americans.

Why Is Social Security a Good Example of Effective Government Policy?

Social Security is a good example of effective government policy because it addresses economic vulnerabilities through a well-structured, self-sustaining program. Funded by payroll taxes and managed with long-term sustainability in mind, it continuously supports retirees, disabled individuals, and survivors without requiring additional taxpayer funding. Its design promotes collective responsibility, where current workers fund the benefits of today’s retirees, just as they will be supported by future generations. This cyclical approach ensures the program’s longevity while protecting individuals against poverty in their old age or during periods of disability.

What Are the Long-Term Benefits of Social Security?

The long-term benefits of Social Security extend beyond individual financial stability. It acts as a powerful tool for poverty reduction, economic stability, and intergenerational support. By guaranteeing a steady income to retirees and disabled individuals, Social Security reduces the risk of poverty among vulnerable populations. Over time, it also promotes economic stability by ensuring that millions of Americans can continue to participate in consumer spending, even after they leave the workforce. This reliable income flow contributes to overall economic resilience, making Social Security not just a benefit but a stabilizing force for the national economy.

How Does Social Security Address Longevity Risk?

Longevity risk—the risk of outliving one’s savings—is a significant concern for retirees. Social Security addresses this risk by providing lifetime benefits that are not subject to depletion as personal savings might be. Unlike private retirement accounts, which can be exhausted, Social Security payments continue for as long as the beneficiary lives, ensuring financial security even in advanced age. This guarantee is crucial as life expectancies continue to rise, requiring retirement funds to last longer than ever before. For many, this aspect of Social Security brings peace of mind during retirement.

How Does Social Security Impact Consumer Spending?

Social Security significantly impacts consumer spending by providing steady income to millions of beneficiaries each month. This reliable flow of funds helps maintain consumer demand, particularly in local economies where retirees spend their benefits on housing, groceries, and healthcare. During economic downturns, Social Security payments help to stabilize the economy by ensuring that beneficiaries have the financial means to continue purchasing essential goods and services. This effect serves as an economic buffer, reducing the severity of recessions and supporting recovery efforts.

What Are the Benefits of SSN for Individuals?

The benefits of SSN (Social Security Number) extend beyond retirement income. An SSN is crucial for accessing government services, securing employment, and opening financial accounts. It also serves as a unique identifier for tax purposes and credit history. For many individuals, having an SSN is the gateway to building a financial identity, applying for loans, and participating fully in the economy. Its role in verifying identity and managing financial transactions makes it an essential tool for financial stability and growth.

Why Is Social Security Important for Future Generations?

Social Security is important for future generations because it represents a commitment to economic security and collective responsibility. The current structure ensures that as today’s workforce pays into the system, they are also contributing to their own future benefits. This intergenerational promise means that future retirees can expect to receive support, just as current beneficiaries do. In an age where pension plans are becoming less common, Social Security remains a critical safety net, offering peace of mind for those planning for retirement. Its sustainability and adaptability ensure it will continue to support American workers for generations to come.

Conclusion: Why Social Security Remains a Vital Component of Retirement Planning

Social Security stands as a testament to effective government intervention in ensuring financial stability and reducing economic disparities. Its role in providing reliable income, supporting families, and reducing poverty underscores its importance in the broader context of retirement planning. Understanding Social Security’s benefits and its economic impact allows individuals to better prepare for their financial future, reinforcing why Social Security is a good example of effective and equitable retirement planning. It not only provides economic stability but also ensures that those who have contributed throughout their working years can rely on financial support in their older age. Additionally, Social Security’s progressive nature guarantees that lower-income earners receive proportionally higher benefits, which aids in closing the economic gap. This aspect is crucial, as it not only lifts individuals out of poverty but also contributes to societal well-being by reducing economic disparities. For these reasons, Social Security remains a cornerstone of retirement planning and an exemplar of effective government policy in action.

Further Reading:

Social Security Benefits: 5 Important Facts